1/ 30 days since @Plasma mainnet launched, the Layer 1 built for stablecoins, offering zero-fee USDT transfers and 1-second blocks with <3s finality.

In just a month, it’s already one of the fastest and most active stablecoin-focused chains ever.

Let’s dive into the data 🧵

2/ Plasma Network Overview

In its first 30 days, @Plasma processed 75M transactions, averaging ~2 M daily.

Over 2.2 M total users, with ~20 K new active wallets daily joining recently.

Explosive early traction for a brand-new L1.

3/ Liquidity

Unprecedented for a mainnet release, @Plasma launched with $2B USDT0 liquidity and saw $4.8B additional inflows in the first two days, now at $7.8B net inflows.

@SeoulDataLabs 4/ Stablecoin Powerhouse

Stablecoin supply hit $7B+ in just two weeks, making @Plasma the #5 largest chain by liquidity (~2% of $304B market):

• USDT0: $4.9B

• sUSDe: $1.25B

• USDe: $0.6B

• syrupUSDT: $0.5B

• wstUSR: $0.18B

• USDai: $0.16B

@maplefinance @ethena_labs @ResolvLabs @LayerZero_Core @USDai_Official 5/ @Plasma launched with 100+ DeFi integrations, quickly becoming @Aave’s #2 market:

• ~$5B supply | $2.1B borrows

• Top assets: USDT0 ($2.2B), sUSDe ($590M), weETH ($560M), USDe ($410M)

• @maplefinance’s $165M syrupUSDT anchors the institutional credit layer

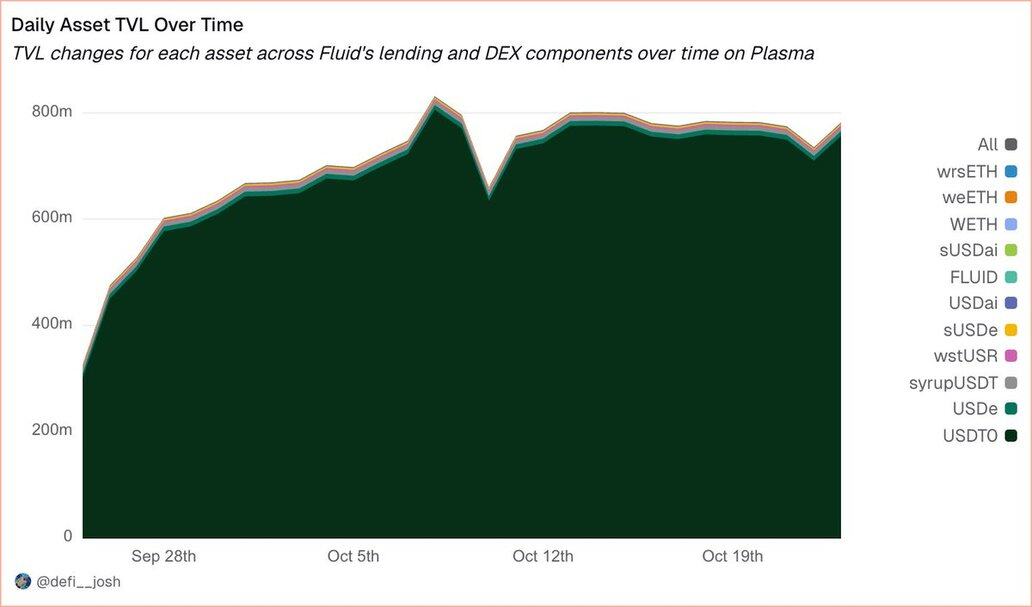

@sealaunch_ 6/ @Fluid merges lending, borrowing, and trading, and is key to @Plasma’s liquidity:

• TVL: $782M (79% lending / 21% DEX)

• 96.7% USDT0 ($756M) — supply cap hit right after launch

• Top pools: USDai/USDT0 $82.5M, sUSDe/USDT0 $36.8M, syrupUSDT/USDT0 $25.8M

7/ @eulerfinance is another primitive that went live on @Plasma on D1:

• $710M deposits | $359M borrows | $351M TVL

• 50.6% util, with USDT0 & USDai >90%

• Top assets: USDT0 ($376M supplied/$309M borrowed), USDai ($55M

/$49M)

• PTs live: syrupUSDT $43M, USDai $29M, USDe $7.7M

8/ In just one month, @Plasma established itself as a DeFi and liquidity powerhouse.

A massive debut for the first stablecoin-optimized L1.

Explore all the data 👇

12.4K

45

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.